If you’re planning a move in North Seattle—think Seattle, Shoreline, Lake Forest Park, Edmonds, Lynnwood, Mountlake Terrace, Bothell, Kirkland, Everett, or Mill Creek—the fourth quarter of 2025 is shaping up to be a “slow-burn” market with more options than last year, slightly better affordability than this spring, and price growth that’s likely to be flat to mildly negative through year-end. Here’s what the latest data and credible forecasts suggest.

Mortgage rates: drifting lower, not diving

After peaking earlier in the cycle, 30-year mortgage rates have eased to the mid-6% range heading into fall. Multiple trackers and outlooks point to a gentle downtrend rather than a sharp drop. Daily/weekly snapshots put average 30-year rates around the mid-6s as of late August, matching the lowest levels since October 2024. That relief—while modest—has already nudged some buyers back into the hunt. (The Mortgage Reports, Investopedia)

For the rest of 2025, Fannie Mae’s research team expects rates to end roughly in the 6.4%–6.5% neighborhood before easing more meaningfully in 2026. Translation: financing conditions may improve a bit in Q4, but they’re unlikely to “fall off a cliff.” The main driver to watch is the 10-year Treasury yield (which influences fixed mortgage rates far more than the Fed’s short-term rate moves). (Fannie Mae, Mortgage Professional, Barron’s)

What this means for Q4: Every eighth or quarter-point dip in rates can revive sidelined demand—especially for well-priced homes in Edmonds, Shoreline, and Bothell—but buyers should plan around rates starting with a “6,” not a “5.”

Inventory: the most choices in years (but still local pockets of scarcity)

On the supply side, the Puget Sound region enters fall with noticeably more homes on the market than a year ago. NWMLS reported 20,781 active listings across its footprint at the end of July, up ~37% year over year. Redfin’s Washington roll-up shows homes for sale up roughly 21% year over year in July, with statewide months of supply around 3.0—a big psychological shift after years of extreme scarcity. (nwmls.com, Redfin)

Even so, conditions still vary block-by-block. Earlier this year, King County briefly dipped below two months of supply, underscoring how fast homes can move in core neighborhoods when they’re priced right and show well. Expect Q4 to feel “balanced-leaning-buyer” in farther-north suburbs (Lynnwood, Everett, Marysville) and closer to “balanced-leaning-seller” for move-in-ready homes inside Seattle’s north end (Green Lake, Ballard, Maple Leaf) and Eastside hotspots like Kirkland. (Seattle King County REALTORS®)

What this means for Q4: Buyers should have the best selection since before the pandemic. Sellers must price precisely and present impeccably—stagers and pre-market prep will matter.

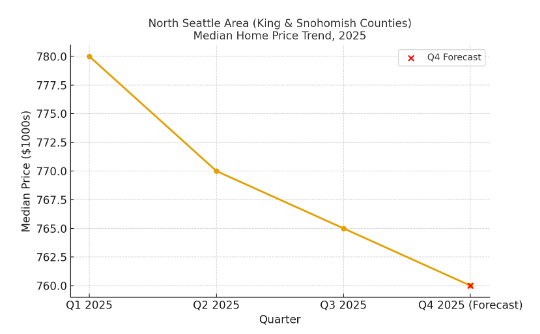

Prices: essentially flat to slightly down into year-end

Price indices show Seattle-area prices hovering near last year’s levels heading into fall. The S&P CoreLogic Case-Shiller Seattle index (a broad, apples-to-apples measure) printed ~401 for June—basically sideways over the past few months. Local reporting in August noted a ~0.7% year-over-year dip in the metro median price to $760,000. Zillow’s national model projects U.S. home values to end 2025 ~0.9% lower than 2024, consistent with a flat-to-slightly-negative glide path. (FRED, Axios, Zillow)

County-level medians reflect that “steady-ish” theme: mid-2025 snapshots had King County around the low-$900Ks and Snohomish around the mid-$700Ks. Don’t be surprised if fourth-quarter medians soften a touch on seasonality and mix (more affordable resales tend to transact late in the year). (Amy Wagner – Prime Listings Group)

What this means for Q4: North Seattle sellers should plan for appraisal-anchored offers and savvy buyers; standout homes can still command strong prices, but average listings that skip prep may linger or require price adjustments.

Demand pulse: improving affordability, but not a frenzy

With rates easing and inventory higher, buyers have begun testing the waters again. National trackers show homes lingering longer than in prior summers, pushing active listings toward a five-year high—even as new listings slow seasonally. That dynamic usually creates room for negotiations on concessions, rate buydowns, and inspection items in Q4. (Redfin)

At the same time, the job market in Greater Seattle remains reasonably healthy. The metro unemployment rate sat around 4.3%–4.5% this summer, close to its long-run average. A stable labor market supports housing demand in employment hubs like Seattle, Bellevue, Kirkland, and the aerospace/tech corridors stretching up through Everett and Paine Field. (FRED)

What this means for Q4: Expect steady, need-based demand—move-up buyers swapping space, first-timers chasing concessions, and relocation buyers tied to job changes—rather than speculative bidding wars.

Rentals and “buy vs. rent”

Rents across Seattle are off their post-pandemic highs but nudged up into summer; Apartment List pegs the citywide median around $2,115, up ~2.7% year over year. If mortgage rates hold in the mid-6s and sellers continue offering concessions, the buy-vs-rent math improves a bit this fall for well-qualified renters in North Seattle and Snohomish County. (Apartment List)

What this means for Q4: Renters on the fence should run the numbers with an updated rate, taxes, HOA dues (when applicable), and a seller credit for a temporary buydown—these deals are common in a Q4 market.

Strategy for Sellers (King & Snohomish)

- Price to the moment, not the memory. Use the last 30–60 days of comps in your micro-neighborhood (Ballard vs. Broadview; Edmonds Bowl vs. north Lynnwood) and expect appraisers to lean conservative. (Zillow)

- Win on presentation. With more competing listings, pre-inspection punch-lists, paint, lighting, flooring refreshes, and exterior cleanup pay off.

- Offer flexibility. Concessions toward rate buydowns or closing costs can be the nudge that converts “touring” into “offer.” Current conditions support that playbook. (Redfin)

Strategy for Buyers

- Shop the rate, not just the house. A 0.25% rate swing can change your monthly payment more than a $10–$20K price difference; ask about buydowns and lender credits. (Barron’s)

- Target homes with longer days on market. Q4 historically delivers motivated sellers; pair that with thorough inspections and smart contingencies.

- Act on standouts. Move-in-ready homes in Shoreline, Kirkland, and parts of North Seattle still attract multiple offers when they’re dialed in and priced right. (Redfin)

Bottom line for Q4 2025

- Rates: Drifting in the mid-6s, modest tailwind if Treasury yields ease. (Fannie Mae, Barron’s)

- Inventory: Higher than last year—best selection in years, with micro-market differences between King and Snohomish neighborhoods. (nwmls.com, Redfin)

- Prices: Sideways to slightly lower into year-end; preparation and pricing precision determine outcomes. (FRED, Axios)

There are always buyers and sellers, in any market—and the Grant Team at RE/MAX Elite is ready to help you navigate Q4 2025 with smart pricing, sharp presentation, and seasoned negotiation. Reach out to discuss your neighborhood, your goals, and a custom game plan.